Evergrande Default Impact - China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

Coming to the Impact of Evergrande we believe the impact would be minimum as China is a closed economy and the crisis is a Country specific crisis. But a hard landing for Evergrande should it default carries risks.

Evergrande Deep Dive What Impact Could A Default Have On Your Crypto By T C Gunter Predict Sep 2021 Medium

A default by Evergrande has been widely anticipated by some corners of the market.

Evergrande default impact. Like Lehman in its heyday Evergrande is massive suggesting a default would be felt widely. At the macro level an Evergrande default could damage consumer confidence if it were to affect households deposits for homes that have not yet been completed but we assume the government would act to protect households interests making this outcome unlikely. With many other developers also feeling the squeeze and struggling to repay loans the potentially colossal default of Evergrande could capsize the.

Evergrande is once again warning that it could default on its huge debts as it struggles to cut costs or find anyone to buy some of its assets. According to media reports Evergrande is likely to default on liabilities including interest payments and debt obligations. Fitch Ratings said that numerous sectors could be exposed to heightened credit risk if Chinese property developer Evergrande were to default.

The third of a three-part series on China Evergrande Group takes a deep dive into how the property developers debt crisis is affecting thousands of suppliers across the construction furnishings. Evergrande has recently made investors clearly aware of the drying up of its cash flow well and amid missed debt payments over the past couple weeks investors are fearing the worst. But allowing Evergrande to fail could have ripple effects throughout China leading to both financial turmoil and civil unrest two things that President Xi Jinping and his risk-averse government.

Since China is considered to be the second-largest economy globally if one of its biggest real estate companies defaults it may have repercussions on the global demand and supply of various commodities. Chinas one-year onshore swap curves surged to the highest in almost four years signaling market worries over liquidity shortage on potential default by a key property developer Evergrande. Unhappy home buyers and suppliers could cause unrest while the financial impact on.

In other words its difficult to say exactly what effect it may have. On its own a managed default or even messy collapse of Evergrande would have little global impact beyond some market turbulence. Stocks of several top commodity companies took a hit for a few trading sessions.

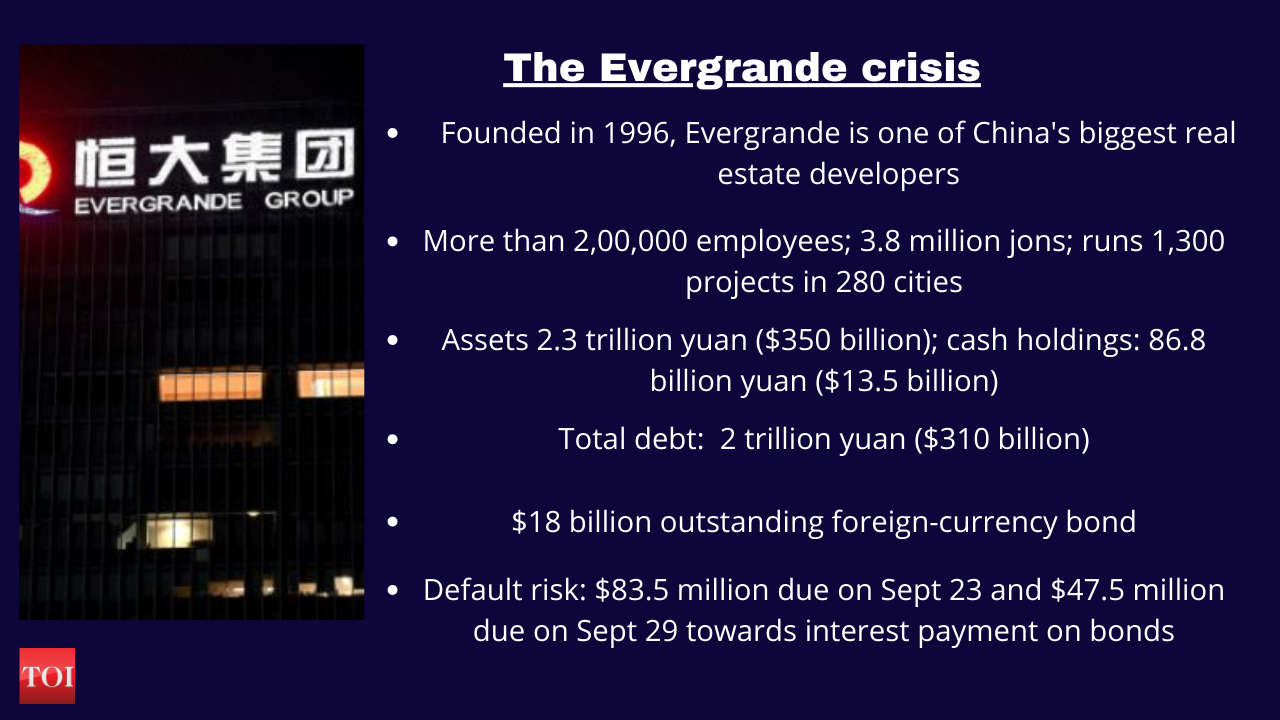

The company has 200000 employees raked in more than. An Evergrande default if it does happen could affect crypto markets although how much by depends on who you ask. Investors assess risks of likely default.

So while Evergrandes US dollar bonds are trading at levels that suggest default Beijing is unlikely to allow the companys woes to proliferate to the point at which they risk creating a. An Evergrande Group default could expose numerous sectors to heightened credit risk another rating agency Fitch said in a note late on Tuesday but it added the overall impact. Smaller banks with higher exposure to Evergrande or to other vulnerable developers could face significant increases in non-performing loans depending on how the Evergrande situation develops Fitch Ratings said.

Questions loom about a government bailout and whether Evergrande is in fact too big to fail. After missing four payments the company made a key payment to bond holders staving off default. Evergrande is Chinas second-largest real estate company.

Unhappy home buyers and suppliers could cause unrest while the financial impact on. A default by Evergrande has been widely anticipated by some corners of the market. As the company struggled to repay creditors global markets responded with selloffs.

The impacts from a large default by Evergrande would be remarkable Kristie Lu Stout Julia Horowitz Laura He and CNNs Beijing bureau contributed to this report. Crisis at Chinese property developer threatens the bond market housing market and wider economy. Coming to the Impact of Evergrande we believe the impact would be minimum as China is a closed economy and the crisis is a Country specific crisis.

Given Evergrandes influence on the global economy could its looming default be a catalyst for a repeat of the Lehman default and subsequent financial crisis. Interbank borrowing costs also rise ahead of the central banks medium-term lending facility operation on. A default in the company will impact China domestically because Evergrande has about 2 trillion yuan worth of assets which is equivalent to almost 2 of Chinas GDP.

One level of impact has already been absorbed by the supply chain players. Growing fears of China Evergrande defaulting rattled global markets on Monday as investors worried about the potential impact on the wider.

What Is The Evergrande Debt Crisis And Why Does It Matter For The Global Economy World Economic Forum

What Would An Evergrande Default Look Like The New York Times

China S Evergrande In Uncharted Waters After Key Interest Deadline Passes News Dw 24 09 2021

Evergrande Not Too Big To Fail China Can Manage Its Collapse Enodo Asia Financial News

What Is The Evergrande Debt Crisis And Why Does It Matter For The Global Economy World Economic Forum

Evergrande Averts Default With Interest Payment Reports Evergrande The Guardian

An Evergrande Default Could Reset The Chinese And Global Economy Icis

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

Explainer How China Evergrande S Debt Troubles Pose A Systemic Risk Reuters

Fitch Warns That Evergrande Defaults Could Have Economic Benefits For China As A Whole Jioforme

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

Evergrande Default Could The Property Giant S 250 Billion Debt Spark A Global Financial Crisis Euronews

China Evergrande Crisis Deepens On Report Of Interest Payment Miss Asia Financial News

Evergrande S Rising Default Risk All You Need To Know Times Of India

How The Chinese Evergrande Crisis Affects Global Markets

Evergrande Debt Crisis Bond Default Impact On Indian Real Estate Buying Luxury Property

Evergrande Avoided Default In The Last Minute R Cryptocurrency